Fed Talking About Big Rate Hikes, But Mortgage Rates Moved Lower It was a week for paradoxes on several fronts, most notably when mortgage rates moved lower just after the Fed floated the idea of an even bigger hike. There’s a popular misconception that the Fed sets mortgage rates, or…

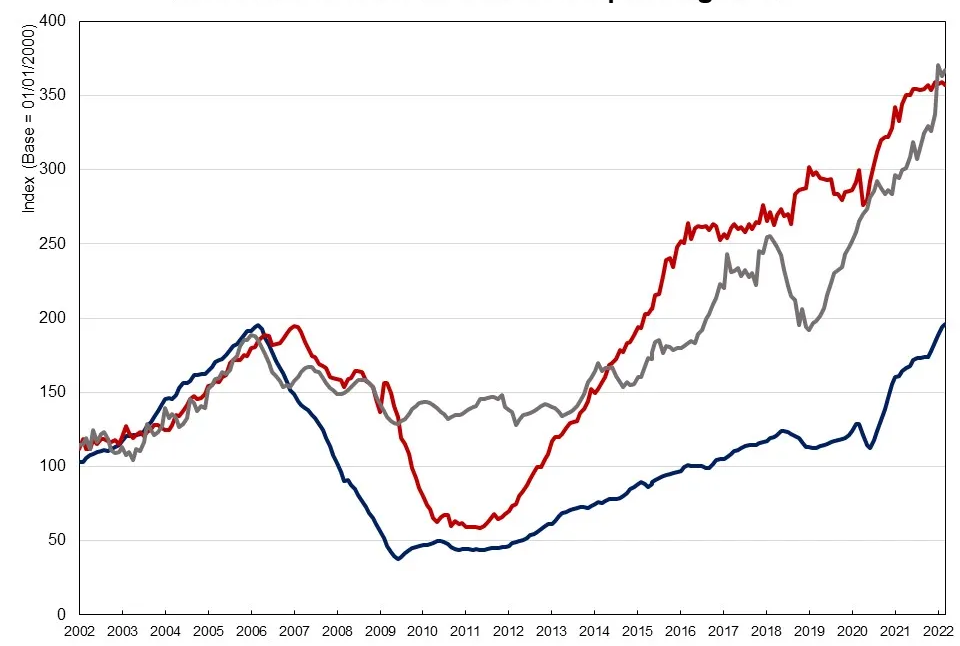

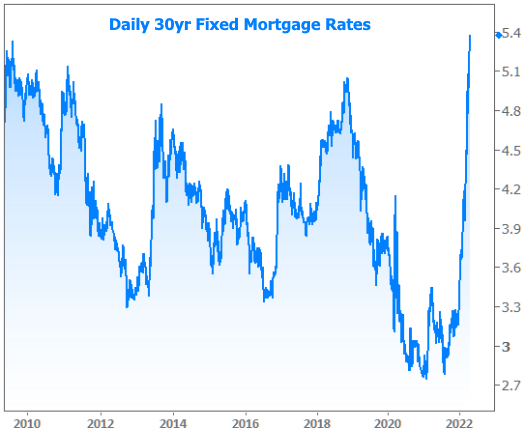

In 2020 and 2021, housing boomed and rates plummeted at a pace that many considered to be unsustainable. 2022’s role is to take things back in the other direction. In other words, things are “normalizing” after a period of frenzied movement. The normalization process can seem scary in cases where the…

2022 is Already The Worst Year For Rates Since 1979 2022 has already had its fair share of bad news for mortgage rates, but this week was not to be outdone. It began as just another reasonably bad week with rates moving moderately higher, but still safely under the recent 13 year…

How much money can I take out on my refi? Like a lot of things in the mortgage world, that depends on your credit score and other specifics regarding your unique scenario. Most programs allow up to 80% or 90%, though we do have access to a niche program allowing…

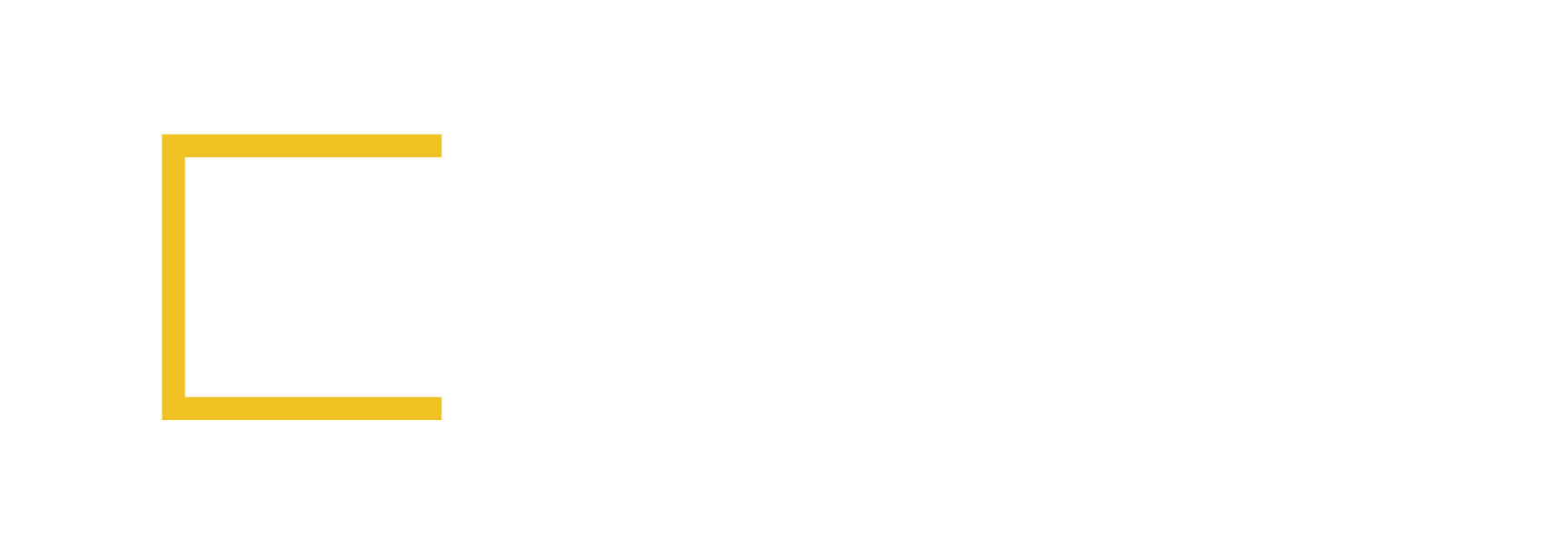

It was yet another tough week for the mortgage market with rates rising to their highest levels since 2009, but how high have they actually risen? There’s a correct answer and then there’s the answer that can be gleaned from widespread media coverage of Freddie Mac’s weekly mortgage rate survey.…

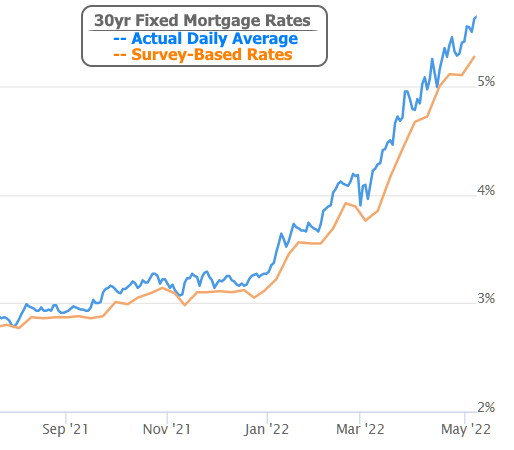

The volume of mortgage application submitted during the week ended April 29 ended a seven-week slide. The Mortgage Bankers Association (MBA) said purchase applications were substantially higher than the prior week while refinance applications held their own. MBA’s Market Composite Index, a measure of application volume, increased 2.5 percent on…

Total construction spending continues to roar ahead of its 2021 pace, led again in March by another double digit increase in the residential component. The U.S. Census Bureau says the investment in all types of construction was at a seasonally adjusted rate of $1.731 trillion in March, an 0.1 percent gain compared…

It’s hard to avoid bad news about rising mortgage rates in 2022, but you can’t believe everything you read. It is true that mortgage rates have been surging higher in 2022. In a nutshell: the pandemic pushed rates significantly lower at first the Fed was very aggressive in stimulating the…