Fed Talking About Big Rate Hikes, But Mortgage Rates Moved Lower It was a week for paradoxes on several fronts, most notably when mortgage rates moved lower just after the Fed floated the idea of an even bigger hike. There’s a popular misconception that the Fed sets mortgage rates, or…

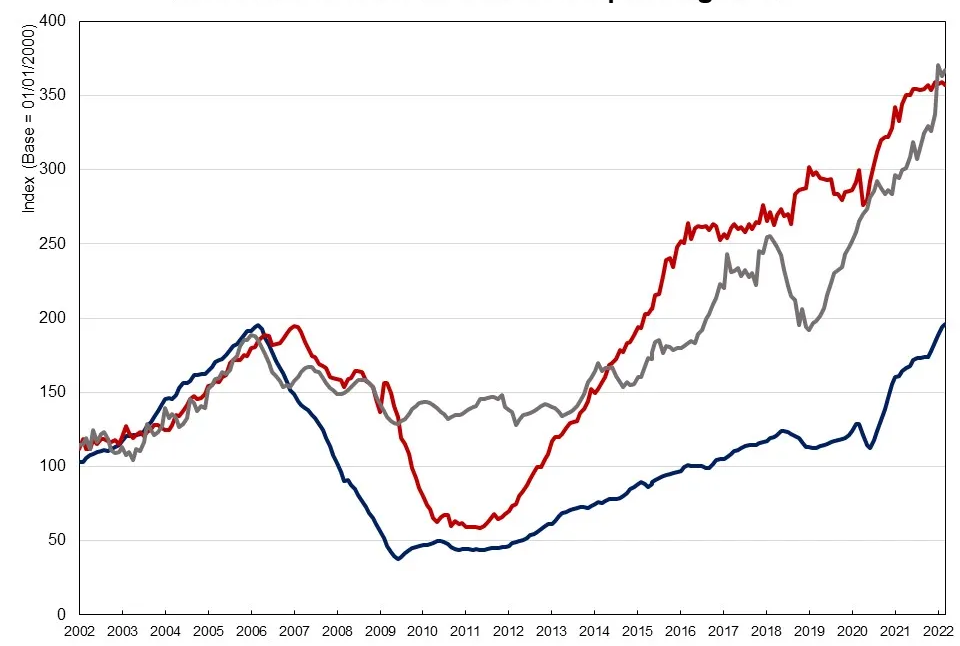

In 2020 and 2021, housing boomed and rates plummeted at a pace that many considered to be unsustainable. 2022’s role is to take things back in the other direction. In other words, things are “normalizing” after a period of frenzied movement. The normalization process can seem scary in cases where the…

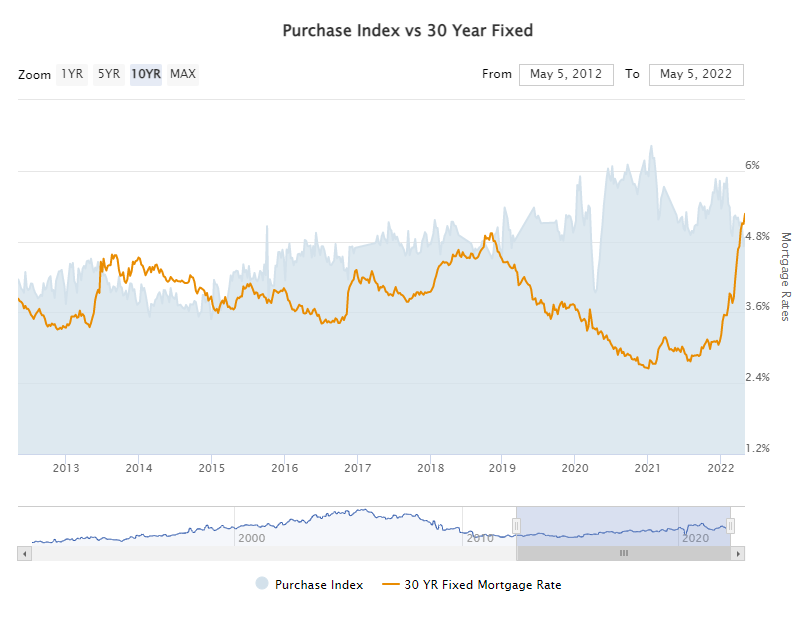

The volume of mortgage application submitted during the week ended April 29 ended a seven-week slide. The Mortgage Bankers Association (MBA) said purchase applications were substantially higher than the prior week while refinance applications held their own. MBA’s Market Composite Index, a measure of application volume, increased 2.5 percent on…

Total construction spending continues to roar ahead of its 2021 pace, led again in March by another double digit increase in the residential component. The U.S. Census Bureau says the investment in all types of construction was at a seasonally adjusted rate of $1.731 trillion in March, an 0.1 percent gain compared…