Everything you ever needed to know about the loan process. From start to finish, this process usually takes 5 weeks or more, depending on how complex your situation is and how long it takes to get under contract. If you have your financial ducks in a row and you’re…

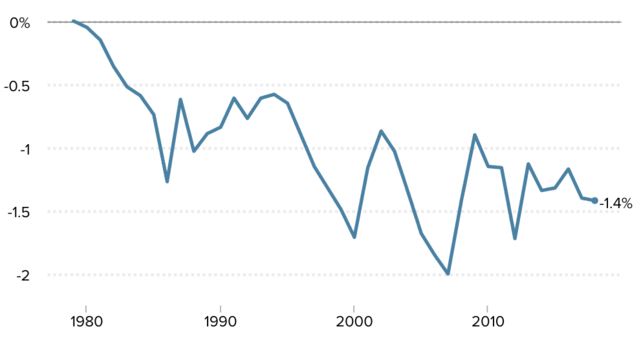

2022 is Already The Worst Year For Rates Since 1979 2022 has already had its fair share of bad news for mortgage rates, but this week was not to be outdone. It began as just another reasonably bad week with rates moving moderately higher, but still safely under the recent 13 year…

What is DTI? Debt-to-Income ratio. It means a lot when you are trying to qualify for a home loan! The amount of your monthly debt obligation (credit cards, auto loans, student loans, child support, etc.) is divided by the amount of your gross monthly income (prior to any deductions), which…

How much money can I take out on my refi? Like a lot of things in the mortgage world, that depends on your credit score and other specifics regarding your unique scenario. Most programs allow up to 80% or 90%, though we do have access to a niche program allowing…

There are several qualifying factors that you’ll be asked about when you talk to us. We’re looking for stable, predictable income so we can trust that you have the ability to repay your loan. When we talk, we’ll ask you about 4 things: Credit Score. The higher your credit score,…

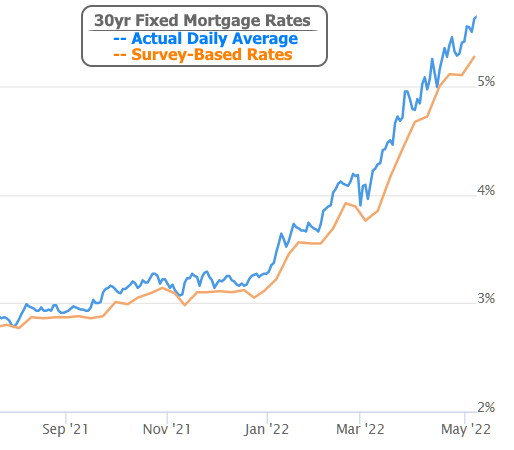

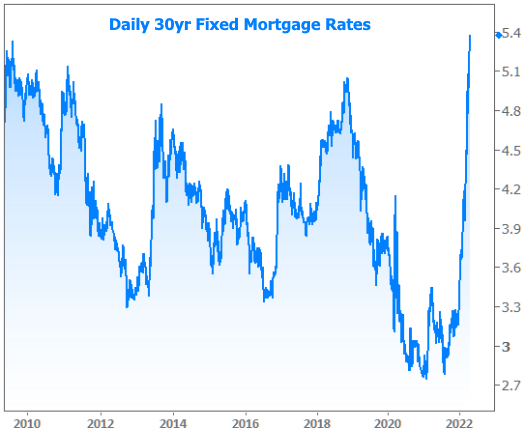

It was yet another tough week for the mortgage market with rates rising to their highest levels since 2009, but how high have they actually risen? There’s a correct answer and then there’s the answer that can be gleaned from widespread media coverage of Freddie Mac’s weekly mortgage rate survey.…

It’s hard to avoid bad news about rising mortgage rates in 2022, but you can’t believe everything you read. It is true that mortgage rates have been surging higher in 2022. In a nutshell: the pandemic pushed rates significantly lower at first the Fed was very aggressive in stimulating the…