There are several qualifying factors that you’ll be asked about when you talk to us. We’re looking for stable, predictable income so we can trust that you have the ability to repay your loan. When we talk, we’ll ask you about 4 things:

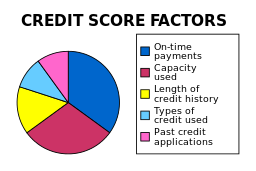

- Credit Score. The higher your credit score, the better your interest rate will be.

If your credit score is above 640, it is fairly easy to qualify (if your other factors are okay). If you’re below 640, it’s still possible, but more of a

If your credit score is above 640, it is fairly easy to qualify (if your other factors are okay). If you’re below 640, it’s still possible, but more of a

challenge and you will have a higher interest rate to compensate for the risk. If your credit score is below 600, then you fall into a very high risk category and home loans get very expensive. - Income. You need to know what your monthly income is before any deductions. If you’re not sure because you’re paid every other week or other non-monthly pay schedule, don’t worry. we’ll calculate it quickly and let you know. You’ll need to have worked at the same kind of work (not necessarily the same job) for at least 2 years. 2nd jobs, overtime and bonuses will also need to have a 2-year history.

Debts. You’ll need to know what the balance and minimum monthly payments are for all your current debts: credit cards, car loans, student loans, alimony and child support, etc. You don’t need to count utilities or other payments you make for services. Once we know your income and debts, we’ll figure out your debt-to-income ratio (DTI), which should be no more than 43%, though it is possible to qualify if your DTI is higher.

Debts. You’ll need to know what the balance and minimum monthly payments are for all your current debts: credit cards, car loans, student loans, alimony and child support, etc. You don’t need to count utilities or other payments you make for services. Once we know your income and debts, we’ll figure out your debt-to-income ratio (DTI), which should be no more than 43%, though it is possible to qualify if your DTI is higher.- Down Payment. How much have you saved for a down payment? You should save at least 3.5% of the purchase price for a down payment. There are down payment assistance programs so you don’t have to come up with as much money, and you can be gifted the money for a down payment by a family member, so if you haven’t saved at least 3.5%, you can still qualify.